Various other elements like your individual monetary background as well as your household's driving records can all affect the price of your costs - prices. To better recognize what aspects are in play, allow's take an appearance at what enters into calculating the expense of vehicle insurance coverage and also dig deep right into the factors that persuade your insurance prices.

A lot of auto insurer will have their insurance policy representatives accumulate info regarding your auto when developing a quote. They'll likewise ask you concerning your favored protection limits, which can adjust the cost of your cars and truck insurance plan. Agents will check out state-mandated coverage needs to ensure you're getting the security you need to drive lawfully.

Typically, this will certainly indicate you'll be transforming your plan, whether you're including your brand-new spouse or removing your ex. You may be able to save money on vehicle insurance policy with a great credit rating.

affordable low-cost auto insurance dui auto

affordable low-cost auto insurance dui auto

If you've not had a major mishap in five years, this can benefit your automobile premium. When no residential or commercial property damages or responsibility insurance claims have actually been made against you in the recent past, you stand to get a better rate. The expense of your auto as well as the year it was generated will certainly be made use of to aid create your insurance rates.

The location and also zip code where your auto is registered will have an influence on the quantity you pay for insurance. Safe communities with low crime rates are typically associated with reduced insurance prices. If you're able to pack various other plans with your auto coverage, you can save money on your premium.

Does Car Insurance Go Down At 25? - Experian Things To Know Before You Get This

With American Family Members Insurance coverage, you may have the ability to conserve big. Consult your representative to read more concerning packing. You'll likely be inquired about the way you mean to use your vehicle when you request automobile insurance policy. You'll be inquired about the distance you'll be driving to as well as from job each day and also concerning your forecasted annual mileage.

One method you can control the price of your automobile insurance policy is to ask for quotes on various protection restrictions - cheapest car insurance., you're going to probably need something close to full coverage to meet those demands.

If your state does not need you to have insurance coverage, adding bodily injury obligation insurance coverage, you might be doing on your own a big support if you're ever before found responsible for an accident that triggered injuries to others. At American Family, we'll award you when you enlist in My Account as well as choose paperless payment.

When establishing which gender pays more for automobile insurance, insurance coverage firms consider numerous historic variables, such as the tendency of male motorists to enter even more accidents. insurance company. However, sex is not the only consideration that's made when policy rates are being computed. Insurer also look at a vehicle driver's age and typical factors such as driving history, credit history, as well as safety and security features on the vehicle.

Considering that women are less most likely to be in a mishap than males and also that men are a lot more most likely to drive without their seat belt, it may shock chauffeurs to discover that, usually, women pay even more for cars and truck insurance policy than their male equivalents. According to The Zebra, women pay $740 for their six-month premium versus males who can expect to pay an average of $735 for 6 months (vans).

Rumored Buzz on Cefcu: Home Page

Regardless of their gender, younger vehicle drivers will pay even more for their vehicle insurance coverage costs than any other demographic, according to Huff, Post. The factor young vehicle drivers experience high rates is that, as a populace, they are extra likely to be high-risk vehicle drivers by speeding, neglecting to wear their seatbelt, and also breaking various other driving regulations.

Even though women pay even more for their vehicle insurance costs on standard, at much less than 1 percent over what men pay, this is turned around when contrasting young motorists. This is due to the fact that of the risks male drivers under 20 take when driving.

When a driver turns 25, however, their car insurance prices generally reduced, and also men and females with the exact same driving record can anticipate to pay nearly the same. Nonetheless, women pay a little even more than males by less than 1 percent, according to Insurance coverage Journal. After the rate decrease at 25 years of age, drivers can typically expect to maintain around the same rate of insurance policy until they reach the age of 60 when there is an additional significant decline - low cost auto.

automobile vehicle vans laws

automobile vehicle vans laws

Also if a wedded chauffeur is young, their marriage standing conserves them around 21 percent versus their single counterparts. The distinction is even a lot more noticable when contrasted to wedded as well as solitary womena young, solitary woman can anticipate to pay 28 percent even more than her married women buddies. The reason that marital status makes such an influence is that married people are normally much more accountable than songs, consisting of in their driving practices, per Huff, Post.

All chauffeurs in Michigan can anticipate to pay more than in other states, according to Auto and Vehicle driver, also before taking into consideration the age and gender of a policyholder. Other Ways to Conserve on Insurance, Fortunately, there are ways to save money on automobile insurance, even if a chauffeur falls under the team with the highest possible prices.

The Greatest Guide To Auto Insurance Premium Comparisons - Mass.gov

According to The Zebra, an at-fault crash will cause insurance coverage rates to raise by 42 percent usually, plus the infraction remains on a driving record for 3 years, after which the prices will go back down as long as there aren't any kind of various other infractions. Some motorists think that they should submit insurance claims for every mishap, but that's not always the case - suvs.

In-Car Devices, There are some insurance provider that a lot more very closely keep an eye on the means a driver operates their automobile by installing a device that will give analyses based upon stopping behaviors, rate, as well as time of day the lorry is operating. According to esurance, these telematics analyses help when finding out prices.

Vehicle drivers will certainly intend to reconsider removing protection if their vehicle is worth greater than $4000, according to Guarantee. For vehicles worth more than $4000, drivers might intend to increase their deductible instead of getting rid of crucial coverage. Other Price cuts, According to The Zebra, most insurance firms use the same basic discounts, as well as drivers will intend to consult their insurance coverage agent to determine what they get approved for (suvs).

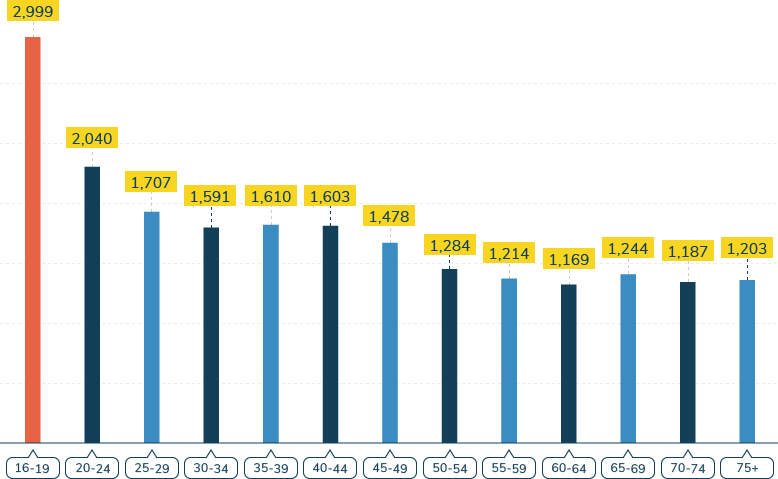

Complete protection automobile insurance policy rates by age and also sexFull insurance coverage cars and truck insurance coverage is a design of car insurance policy, not a certain product. Full coverage plans include added coverage in addition to state minimum needs. The prices below reflect a policy with extensive as well as collision insurance policy along with obligation, without insurance vehicle driver protection and other state-required protection where required.

That means plans will certainly differ in protection based on where you live. insurance companies. The prices listed below reflect nationwide standards for minimum insurance coverage, so actual rates can differ commonly by state. As numerous new vehicle drivers have actually uncovered, being young is an easy way to pay even more for car insurance policy. There are at the very least two reasons for that greater rate.

The smart Trick of Minor Accident Reddit. Minor Bike Accident Leads To $19,000 ... That Nobody is Discussing

Second, research studies have actually revealed younger drivers are a lot a lot more most likely to be in mishaps. These rates are for private insurance coverage plans, which are typically greater than rates for family members policies with new motorists. The accident price for young chauffeurs assists clarify why auto insurance coverage for 20-somethings can place such a damage in your wallet.

Still, also if your state doesn't permit business to base prices on age, you could pay even more when you're young. If you have actually been driving for just a year or 2, you're likely to pay even more than someone that has been behind the wheel for a years.

Our analysis found that starting at age 20, men pay greater ordinary insurance coverage rates. By age 30, ladies and also men pay practically equal prices, however the cost void never really shuts.

Younger males are also a lot more prone to casualties, with prices for male chauffeurs ages 16 to 19 almost twice those for women drivers of the very same age. Fatal collision rate per 100 million miles driven, Figures from the IIHS based on evaluation of the U.S. Department of Transport's Fatality Evaluation Reporting System 2017 data.

By age 30, this difference goes down to simply 2%. Again, this data is based on a national standard of the five biggest car insurers, so car insurance coverage prices in your state might be a lot lower. It's one of the factors we constantly recommend searching to compare automobile insurance prices - insurance affordable.

2022 Car Insurance Rates By Age And Gender - Nerdwallet Things To Know Before You Buy

cheap auto insurance vehicle insurance insurance affordable vehicle insurance

cheap auto insurance vehicle insurance insurance affordable vehicle insurance

Some care much more about your driving background, while some care more about the vehicle you drive. Car insurer are also restricted by policies for setting automobile insurance prices that differ in each state. States right next to each various other can have big swings in average expenses due to neighborhood regulations.

Cross the line into Georgia, which exact same driver obtains an average price decline of over $1,000, down to $1,698. Therefore, where you live is one of the largest consider the price you ultimately pay. To get a concept of what to expect, examine out ordinary car insurance prices in your state.

This means when applying for car insurance, they may ask for your gender, when they truly suggest sex. They might additionally ask for recognition that does not show your gender accurately.

Age is the biggest variable in establishing your vehicle insurance coverage prices (risks). Maintain reading to learn when auto insurance coverage prices usually drop and what you can do to lower them, outside of having one more birthday.

And bear in mind that despite your age, you must constantly compare auto insurance coverage quotes from a number of carriers so you can discover the ideal protection and cost for you. Utilize our tool below or provide our team a phone call Motor1's assigned quotes group at to obtain complimentary, personalized quotes 7 days a week (cheaper car insurance).

How Best Cheap Car Insurance Companies For May 2022 - Cnet can Save You Time, Stress, and Money.

But insurance Homepage companies appreciate just how knowledgeable you are, so you'll probably see an extra significant drop around your 25th birthday. Eventually, the more years on the road you have, the reduced your costs will likely be. cheapest car. If you're a young chauffeur or the moms and dad of a teenager, you might be questioning when you can obtain some alleviation from high vehicle insurance coverage rates.

Your insurance supplier will certainly check out the number of years you have actually been driving and your driving document in the last few years. This will certainly aid identify any kind of modifications in your costs. As you get experience and continuously drive without accidents or tickets, you're more probable to see a reduction in your car insurance coverage prices.

Cars and truck insurance coverage rates are determined by the quantity of threat a vehicle driver presents to an insurance company. This threat is figured out by average vehicle driver data. Insurance policy business intend to protect themselves, so they charge a higher rate for motorists that are more probable to get into a crash, submit a case, or get a moving offense. cheapest car.

16- to 19-year olds are virtually three times a lot more likely to be in a fatal crash than drivers age 20 as well as older., you can still go shopping around for rates within your spending plan.

To save cash on automobile insurance coverage, numerous households consider signing up teenagers in secure driving programs or vehicle drivers ed training courses. These programs are built to alert drivers when they are succeeding, in addition to where to make modifications to boost safety. A lot of insurer provide discount rates to teens that complete these programs efficiently as well as reveal indications of risk-free, responsible driving. affordable auto insurance.

4 Easy Facts About Auto Insurance Premium Comparisons - Mass.gov Explained

Use our device listed below or call us at What Else Impacts Your Auto Insurance Policy Price? In enhancement to age as well as driving history, below are some other things that can influence typical car insurance policy prices: Gender Location Marital status Debt score Type of car you're guaranteeing Security features on your lorry While several variables like age and also sex are out of your control, there are still many points that could certify you for lower prices.

On the other hand, foreign as well as luxury autos are thought about a risky for cars and truck insurance coverage companies due to the fact that components are costly. Several chauffeurs see declines in automobile insurance coverage rates after they acquire much more driving experience, stay clear of getting tickets, and also avoid accidents.