There are numerous steps that company owner can require to ensure that their industrial automobile insurance coverage are valued fairly. First as well as primary, a tidy driving document is the number one aspect that can reduce the price of the policy. Since the insurance coverage limitation has such a big influence on the plan's cost, it's worth closely examining the amount of insurance coverage you require.

cheap car laws affordable car insurance auto insurance

cheap car laws affordable car insurance auto insurance

We do not advise decreasing coverage limits only for the benefit of saving money. It is worth taking a close look at the practical prospective costs linked with an occurrence and also reducing the protection limitation to an appropriate degree for the risk. Increasing the deductible on a commercial auto insurance coverage is another means to keep expenses down.

Commonly, insurance providers will certainly offer a little price cut to insurance holders that pay off their annual premium balance at the start of the coverage duration. Several insurance suppliers incentivize businesses to purchase more of their company insurance plans from them by supplying a discount for "packing" multiple insurance plan. Sometimes these are referred to as multi-line discount rates. cheap car insurance.

Taking safety preventative measures, maintaining a safe driving document, and also being wise concerning insurance coverage limits and also discounts are the most effective methods to maintain the costs down on a business auto insurance coverage. Constantly ask potential insurance service providers what price cuts they provide and how you can lower the cost of the policy - vehicle.

4 Simple Techniques For Best Car Insurance Companies Of 2022

Locating The Most Effective Industrial Auto Insurer There are several service vehicle insurance policy plans offered through various brokers as well as insurance provider. The insurer's plan you select will be what determines the insurance coverage you obtain, the quantity you pay, and your experience as a customer. Throughout the training course of our research study, we examined numerous underwriters. auto.

Plan Options The protection choices that the insurance company uses may be one of the most crucial variable to consider when you're buying business vehicle insurance policy for your organization. Most insurance provider, though not all, will can providing the general insurance coverage that the majority of individuals require for the service they carry out. It is essential to comprehend the limits of particular policies, as well as to locate the one that can be ideal customized to your company.

Read over the firm's commercial automobile policy info that they give on their web site. This can take a while, as not all insurer do a great task of discussing their coverage alternatives, especially when the coverage is a little a lot more nuanced, as is the situation for industrial car. If a firm offers terrific optional policy extensions or has a very comprehensive base policy, they tend to market those things on their internet site.

Make use of the details they offer to analyze their policy because it's a great indicator of just how much they value customers of their business auto policies. J.D. Power likewise offers some understanding into each insurer's policy offering in their insurer researches, however the most effective method to learn more about an insurance provider's insurance coverage is to call and also ask an agent.

An Unbiased View of What Is The Best Car Insurance?

Some insurance coverage companies automate a lot of their customer support, which can be frustrating when you are a client. The most effective insurance companies will certainly treat callers with respect as well as ensure to resolve every one of their issues prior to hanging up the phone. Consumer Contentment Apart from the business's capacity to provide you protection suited for your requirements, what could be more vital than consumer fulfillment? Customer complete satisfaction scores will illustrate just how clients feel regarding their experience with the different insurance policy business.

The method information reaches you and also the method the business communicates with you throughout the period of your connection with them must be a significant consideration. There are several third-party companies that assess insurance company credibilities with their consumers (insurance companies). The and are the most well understood as well as reliable sources for this details.

Power. The customer support experience defines an insurance policy holder's relationship with the insurance company. Underwriter Financial Toughness The financial stamina of the underwriting company is an aspect that we value when selecting a supplier. It's difficult to visualize that your insurance coverage carrier might be incapable to pay the worth owed to you in case of a covered loss. suvs.

Much of the companies we review below are public business, whose monetary information is publicly readily available for any person curious about watching it. If economic stamina of the insurer is a sticking factor for you, you can check out a company's monetary records as well as figure out on your own exactly how steady and also reliable that company is.

7 Ways To Find Good, Cheap Car Insurance - Credit Karma Things To Know Before You Buy

There are a number of economic score agencies that do this. In our evaluation, we considered just one of the most recognized and also credible economic ranking agency reports. These economic rating agencies are: Established in 1899, A.M. Ideal is a Nationally Acknowledged Analytical Score Company (NRSRO) in the United States (insurance companies). They focus solely on rating companies in the insurance policy market.

prices vans car insured car

prices vans car insured car

All of the companies that we suggest are extremely strong according to these significant rating agencies. Rates & Quotes Rates can be difficult to evaluate when comparing industrial auto insurance companies - cheap. Most of the time, insurers won't (or merely can't) give enough insight right into rates until they get info from you.

Oftentimes, obtaining a quote can be a lengthy procedure that needs a large amount of information and also documents. One of minority insights right into rates you can locate without obtaining and comparing quotes is the information that J. insurance affordable.D. Power provides in their insurance coverage sector researches. One of the metrics that they evaluate insurance policy customers on is their fulfillment with the pricing of their plans.

Not all business we recommend are on the beneficial end of this spectrum, due to the fact that often greater high quality policies are much more costly. Additionally, these ratings often include a variety of policies and are not always depictive of certain kinds of insurance coverage, such as business vehicle insurance. Still, the info that is given can be a beneficial starting point if prices is a main problem.

The Greatest Guide To Florida Car Insurance Among Most Expensive In Us - Wkrg

Local business also require to consider whether any one of their employee's personal cars should be thought about for coverage. New local business may not have their own fleet of vehicles, as well as count on employees to offer their very own transport. low-cost auto insurance. If staff members of a local business are using their personal lorries for business operations, the service acquisition employed and also non-owned automobile insurance coverage, which safeguards the business from problems to vehicles that it does not own.

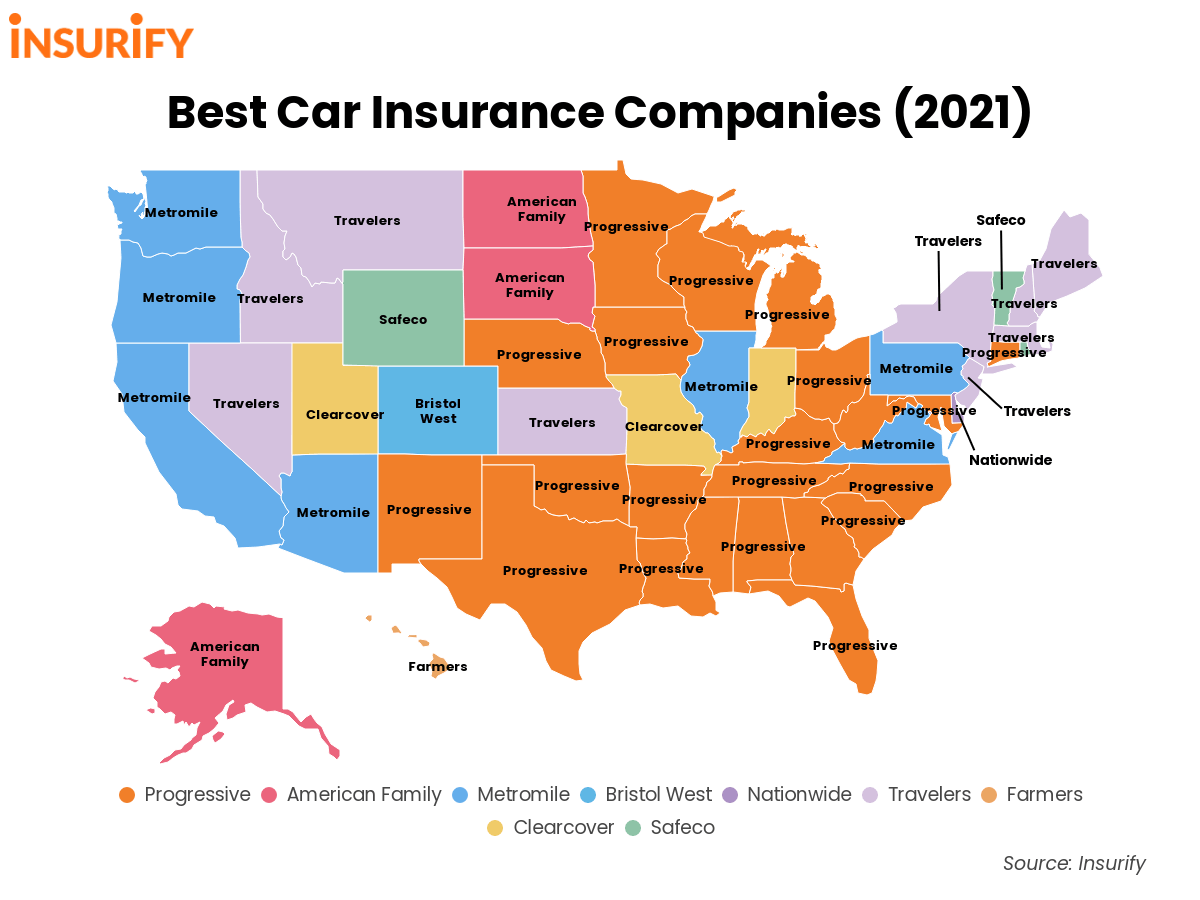

This can simplify billing and frequently brings about price cuts from bundling industrial car with other insurance plan, like employees settlement as well as basic liability. Thinking about the prices as well as coverage that local business require, some business automobile insurance provider are a far better fit than others. cheapest. With these variables in mind, along with the price cuts readily available for local business, Building and construction Coverage places these suppliers the: Progressive, Nationwide, Farmers, Geico Ideal Business Vehicle Insurance Business In order to determine the best industrial auto insurance provider, we researched all of the leading business auto insurance policy service providers.

Modern Commercial Auto (Finest Total) Dynamic # 1 in Business Automobile Insurance Best General Progressive is our leading suggestion for business vehicle insurance policy total as well as also among our top-rated industrial truck insurance companies. Founded in 1937, Progressive has risen to a commanding position as the biggest business automobile insurance provider by costs created. vehicle insurance.

Pros Progressive's usage-based insurance policy program can decrease cost as well as improve safety and security, Provides one of one of the most substantial set of coverage options of any type of insurer on the market Cheats Scored a little even worse than contending insurance firms in a recent client contentment study carried out throughout COVID Progressive's business auto plan options include standard protections for obligation, physical vehicle damages, personal injury, clinical settlements, as well as without insurance or underinsured vehicle drivers for a wide range of organization autos (insurance companies).

The smart Trick of Car Insurance - Start A Free Auto Insurance Quote - Geico That Nobody is Talking About

vehicle insurance trucks insurers car

vehicle insurance trucks insurers car

Modern was just recently marked with an A+ financial stamina ranking by A.M. Ideal (credit). Moodys and also S&P ranked them at Aa and also AA respectively, all suggesting Progressive is monetarily solid. The Better Business Bureau gives Progressive an A+, however one disadvantage of Progressive is that by various other actions of consumer fulfillment, they lag slightly behind their rivals.

cheapest car cheap auto insurance auto vehicle insurance

cheapest car cheap auto insurance auto vehicle insurance

Nationwide Commercial Car (Runner-Up) Nationwide #2 in Industrial Car Insurance Policy Runner-Up Nationwide is our runner-up recommendation for commercial car insurance. Established in 1926, Nationwide is now among the largest insurance providers on the market and also is a particular leader in the classification of industrial auto. car. Nationwide scores effectively in all of our groups, and also there's little they can't do.

At first offering coverage to country farmers in The golden state, it has grown and also created to serve as among the most diverse and also suiting insurance coverage firms in the country. Pros Provides a broader variety of coverage alternatives specifically tailored to service providers, like devices and tools coverage Cons A little lower economic strength scores than a few other huge insurers Farmers supplies several adaptable industrial cars and truck insurance coverage that can be changed based on your organization's requirements while covering typical parts like obligation, personal injury, non-owned vehicle, uninsured and underinsured vehicle driver, and also much more.

Additionally, Farmers has actually been recognized with the Better Service Bureau for 70 years and presently holds an A- ranking with the BBB. To discover how much a Farmers industrial auto plan will set you back, Check out the post right here you can call or start a quote online. You will certainly be linked with a neighborhood farmers agent who can tell you extra about your policy choices as well as potential price cuts - auto insurance.

Some Known Details About Best Car Insurance Companies In California - Cars.com

auto insured car cheap insurance cheapest auto insurance

auto insured car cheap insurance cheapest auto insurance

Geico Commercial Auto (Best for Rideshare) Geico # 4 in Industrial Car Insurance Coverage Best for Rideshare Geico is our top referral for livery insurance coverage. Livery insuranceinsurance for automobiles used by services that create revenue by moving peopleis a part of commercial vehicle insurance that operates a little in a different way depending on that gives the protection. cheapest car.

Their monetary strength ratings are outstanding also, with several of the highest ratings in the market: A.M. Best prices them at an A++ degree, their greatest possible rating, together with an Aa1 from Moody's and also an AA+ from Criterion & Poor's, which are each the second-highest ranking on those corresponding ranges.

If you choose among these companies and click on a web link, we may earn a commission.

That's why it's crucial to do your research and compare your options when selecting the best vehicle insurance provider for your demands. As soon as you have a concept of what your costs could be from a couple of different companies, after that you can take a look at elements that set specific car insurance companies in addition to others, like vehicle coverage attachments or consumer complete satisfaction rankings (cheaper auto insurance).

Some Known Factual Statements About Best Car Insurance Companies For May 2022 - Financebuzz

Accessibility, auto claims complete satisfaction, price, as well as the company's economic wellness are all vital variables we consider in our recommendations. While no single vehicle insurer will be the ideal for every single individual, we believe these are the ones to think about when in the market for car insurance. cheap car. To identify our choices for the ideal auto insurance provider, we started with a list of 25 of the biggest automobile insurer by costs gathered, based on data from the National Association of Insurance Commissioners.

We ruled out any type of business that doesn't have A.M. Finest's score of A+ or higher. We likewise removed any kind of business that are associated with any type of active fraud examinations. Our Picks for the Best Automobile Insurance Provider Business Summary, GEICO GEICO, the second-largest automobile insurance firm in the nation, insures nearly 30 million lorries, according to its internet site.

Vehicle Insurance Insurance Claims Satisfaction Study. It additionally has the most affordable typical annual premium of insurance companies on this list. This budget-friendly business does not provide one of the most distinct price cuts, but it offers lots of standard discounts for customers like financial savings for bundling policies or for having greater than one vehicle on the plan.

The average costs is on the greater end of the spectrum, yet there are lots of discounts to offset your auto insurance coverage premiums. As an example, you can get a price cut on your costs if you have a hybrid or electric vehicle or insure several lorries with Travelers.$1,325: For motorists searching for an auto insurer with strong customer care, Travelers can provide - cheap.