Various other things that can be used to compute your comprehensive coverage price are your driving record, individual details such as your age, credit report score, as well as the deductible quantity you picked to obtain on your policy - cheaper. Comprehensive Click here for more Cars And Truck Insurance Coverage Deductibles as well as Limits, Liability insurance policy protection does not provide deductibles, however extensive does. insured car.

An extensive deductible can average between $100 to $1,000, but can additionally increase to $2,500. You have the ability to personalize and also establish it to whatever you like (laws). Allow's say that you are billed $5,000 for vehicle repairs in an extensive scenario, as well as you have $1,000 - car. That's all you would certainly pay while the insurance business covers the staying $4,000.

Because thorough insurance policy covers cases of this nature, it may look like a clever move (trucks). Nevertheless, this doesn't figure out the cost of your insurance coverage. When would I have the ability to drop my extensive insurance? An excellent way to tell that you may not require detailed insurance coverage is if you can manage the repair services on your damaged car.

vehicle cheap credit low-cost auto insurance

vehicle cheap credit low-cost auto insurance

Another reason was possibly that your automobile has reduced in worth over time (insurance company). Then, insurance coverage would certainly be expensive, as well as the insurance policy payment you obtain will not be that much - cheaper auto insurance. Keep in mind that your cars and truck's ACV is directly proportional to your insurance cost. An additional guideline when it concerns exactly how much you're paying for insurance is to drop it when your prices go to the very least 10% of your car's worth - cheaper car.

Truthfully, that is the only problem you can enter into when foregoing detailed insurance coverage. Let's claim that you stay in an area with a whole lot of storms as well as tornados. While you would be covered under detailed insurance coverage, you would certainly have to submit countless cases since every tornado threats damages to your cars and truck.

The Buzz on Collision & Comprehensive Auto Insurance In California

Insurance Navy will certainly get you safeguarded as well as back when traveling in no time. car. Call us at or demand a quote online. You are likewise welcome to speak to a representative personally at any one of our areas.

cheap auto insurance cheap car insurance auto business insurance

cheap auto insurance cheap car insurance auto business insurance

Vehicle Plan Defense Vehicle plans generally offer the list below kinds of coverage: Physical Injury Obligation: Pays, up to the limitations of the plan, for injuries to various other people you cause with your vehicle (cheap). Property Damages Liability: Pays, approximately the limitations of the plan, for damage to other people's residential property caused by your vehicle. laws.

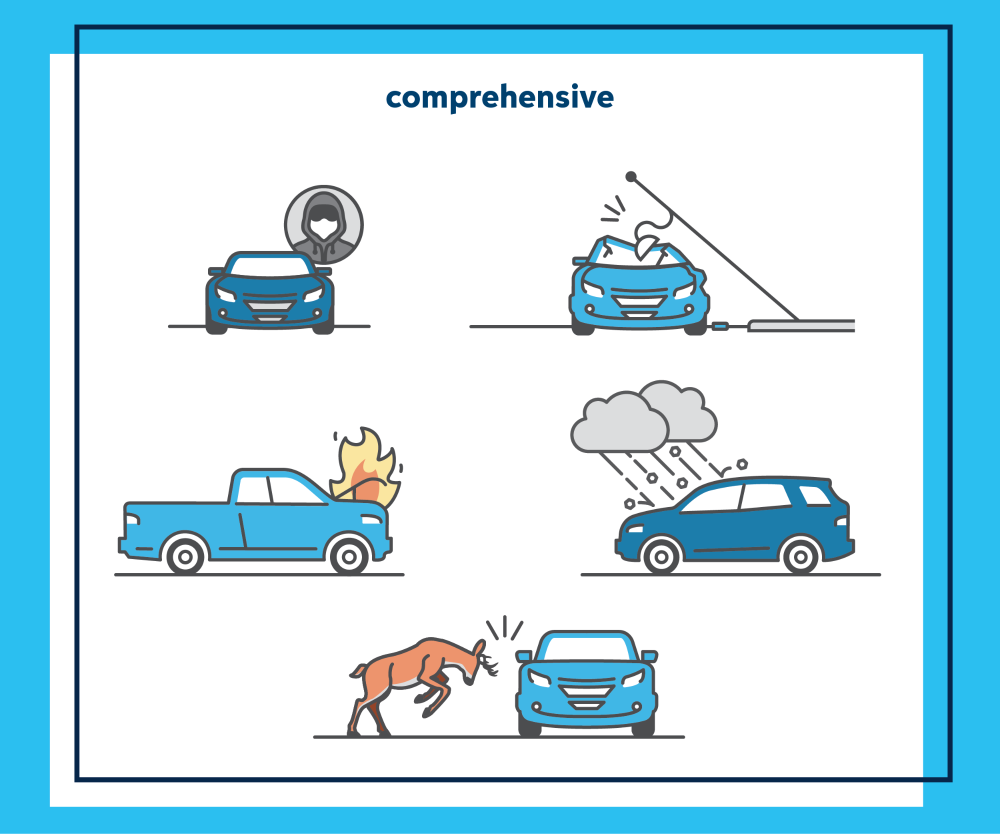

It will pay for damages to your automobile created by accident or distress. Comprehensive: Pays for problems to your cars and truck caused by hazards various other after that collision or distress. Other: There are other protection's such as towing and also auto service which may be offered.

accident credit score suvs low cost

accident credit score suvs low cost

Business must file their rates and kinds with us prior to they are carried out. If the rates are reasonable, ample, and not too much or unfairly prejudiced, the firms might use them. This allows competitors to exist and allows Indiana people to purchase insurance coverage at a reasonable price. car. The prices are open for public evaluation.

laws money cars cars

laws money cars cars

When comparing prices, be sure each business is pricing estimate on the exact same basis. cars. The least expensive plan is not constantly the most effective policy. vehicle insurance. Some ranking factors insurer may make use of are: Age and Sex Marriage Status Vehicle Driver Document Vehicle Use Location of Residence Plan Boundary Deductibles Kind Of Auto Motorist Training Insurance Claims Background Credit History Cancellation or Non-Renewal Constraints Insurance firms must adhere to certain guidelines to cancel or non-renew an insurance plan in Indiana.